Here are some juicy excerpts from the Squid's Letter to Shareholders, complete with appropriate background laugh track.

"Goldman did not and does not operate or manage our risk with any expectation of outside assistance."

"We also believe that financial institutions have a larger obligation to the financial system, the broader economy, and the communities in which their employees work and live."

"By remaining close to our clients, we were able to direct our human and financial capital to those businesses within our market making franchise that most reflected clients’ interests and needs....the vast majority of the risk we take and the revenues we generate is derived from trades that advance a client need or objective"

"Goldman Sachs has pledged to remain a constructive voice and participant in the process of reform, and has been forthcoming in recognizing lessons learned and mistakes made."

"Goldman Sachs announced in 2009 a new effort called 10,000 Small Businesses.

This $500 million, five-year program aims to unlock the growth and job-creation potential of 10,000 businesses across the United States" DIAL 1-800-SEEDCO

"During periods of 2009 when public market liquidity dried up, our senior loan and mezzanine funds, in particular, extended needed capital to a variety of companies whose growth opportunities would otherwise have been limited."

"It is difficult to determine what the exact systemic implications would have been had AIG failed."

BACKING LAUGH TRACK: LINK

Annotated letter by BANZAI7 PRODUCTIONS:

More commentary: here.

A note on just one of Goldman's fine contributions to Maiden Lane III: here.

PDF DOWNLOAD available: here.

GOLDMAN SQUID: BAILOUT SUPERSTARS!!!

.jpg)

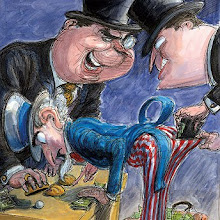

Of course, these rat bastards will avoid jail after obliterating 4T or so in global paper wealth, while still getting their bonuses for doing god's work.

ReplyDeleteThey did everything right!

ReplyDeleteHahahahaaa...

ReplyDeleteNah, they can run but they will be found and dealt with appropriately.

ReplyDeletethey f.....d all the world and now they dont have a 1 pieces greece investment on their portfoy

ReplyDelete